Working with Kaiser Partner means entering a world where wealth is treated as a long-term responsibility, not a short-term outcome. The group operates at the intersection of global wealth management, private banking, fiduciary services, and strategic investment structuring, serving entrepreneurs, families, and institutions across generations.

Based in Liechtenstein, Kaiser Partner works inside one of the most discreet and robust financial ecosystems in the world. Structures are built to last. Governance is precise. Compliance is not a burden, but a framework that allows trust to exist. Decisions are made with decades in mind, not quarters.

What impressed us most was the breadth. Wealth management was only the surface. Beneath it sat family office services, asset structuring, cross-border solutions, and a disciplined approach to alternative investments. Capital was not idle. It was positioned. Protected. Allowed to compound quietly.

Our collaboration extended into this deeper layer. We worked on innovation technology projects where security, resilience, and longevity mattered more than novelty. We supported experiential branding initiatives for portfolio companies the group invested in, translating complex value propositions into experiences that felt solid and credible. Even multisensory design had a role, used not to impress, but to reinforce confidence through space, material, and restraint.

Operating from the Alps gives perspective. The commute through the last stretch of Austria into Liechtenstein sets the tone. You arrive grounded. You listen more. The pace matches the work.

Liechtenstein feels like home because it is built on continuity. Lunch breaks in summer often took us high above Vaduz, where the air thins and conversations sharpen. Up there, wealth stops being abstract. It becomes stewardship.

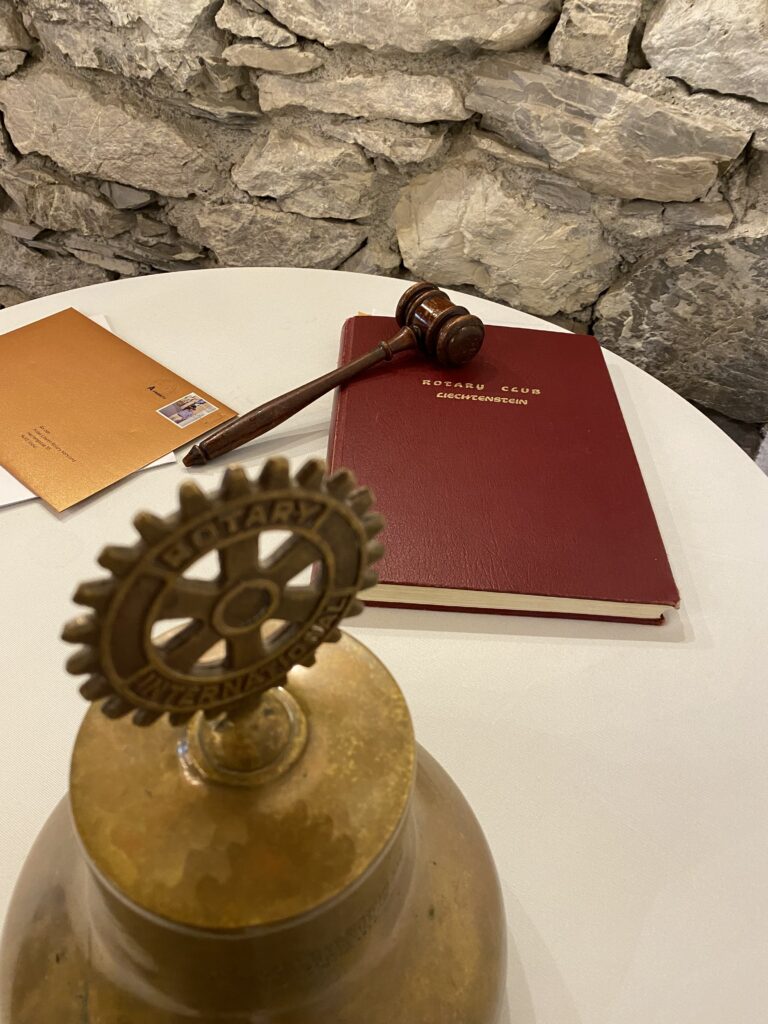

Lunches with friends at the Rotary Club Liechtenstein, often at Hotel Gasthof Löwen, completed the picture. Clear talk. No excess. A reminder that reputation, like capital, is built slowly and lost quickly.

Kaiser Partner showed us that real wealth management is not about accumulation. It is about alignment. Between capital, time, and responsibility.